A) Cleaning expense for a National Guard uniform.

B) Union dues paid by a teacher which were not reimbursed.

C) Personal subscription to a "money" magazine by an investment broker who works for Fidelity so that he can keep up with what is happening in his trade.

D) Travel expense to a conference which was repaid by the employer under an accountable plan.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

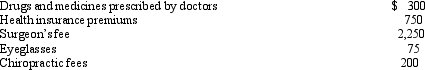

Joyce had adjusted gross income of $28,000 in 2011.During the year,she incurred and paid the following medical expenses:  Joyce received $1,250 in 2011 as a reimbursement for a portion of the surgeon's fee.If Joyce were to itemize her deductions,what would be her allowable medical expense deduction after the adjusted gross income limitation is taken into account?

Joyce received $1,250 in 2011 as a reimbursement for a portion of the surgeon's fee.If Joyce were to itemize her deductions,what would be her allowable medical expense deduction after the adjusted gross income limitation is taken into account?

A) $3,575

B) $3,375

C) $225

D) $25

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following miscellaneous itemized deductions is not subject to the 2 percent of adjusted gross income limitation?

A) Gambling losses to the extent of gambling winnings.

B) Tax return preparation fees.

C) Investment expenses.

D) Union dues.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of a Qualified Tuition Program? (Section 529 Plan)

A) Contributions to the plan are deductible for AGI.

B) Contributions to the plan are deductible as an itemized deduction (from AGI) .

C) Earnings on the plan assets are not taxable if the money in the plan is used for education.

D) Distributions from a Qualified Tuition Program are not allowed for the expenses of room and board.

E) A resident of California may not make a contribution to a Qualified Tuition Program in another state.

G) C) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

William had a bad year.First,his house was burglarized.Then,the brick wall in his yard was damaged by a hit and run driver.The total amount which was stolen was $12,500.The insurance reimbursement was $8,500.The repair of the wall cost $3,000.The insurance reimbursement was $1,000.William's adjusted gross income for the year was $21,000.How much may William claim on his Schedule A as a casualty and theft loss?

A) $3,700

B) $3,900

C) $5,800

D) $6,000

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

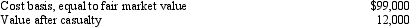

Hortense had adjusted gross income in 2011 of $140,000.During the year,her personal yacht was almost completely destroyed in a boating accident.The yacht had:  Hortense was partially insured for her loss and in 2011 she received a $70,000 insurance settlement.What is Hortense's allowable casualty loss deduction for 2011?

Hortense was partially insured for her loss and in 2011 she received a $70,000 insurance settlement.What is Hortense's allowable casualty loss deduction for 2011?

A) $17,000

B) $86,900

C) $16,900

D) $2,900

E) None of the above.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not deductible as an itemized deduction?

A) Interest on a $300,000 mortgage used to purchase a principal residence.

B) Expenses for moving household goods.

C) A $1,000 contribution to the Heart Association by a taxpayer with $50,000 of AGI.

D) Property taxes on land held for investment in North Carolina by a California resident.

E) A personal casualty loss exceeding 10 percent of the taxpayer's AGI plus $100.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A difference between a Section 529 Plan and an Educational Savings Account is that:

A) The contributions to a Section 529 Plan are not deductible while contributions to an Educational Savings Account are deductible.

B) The maximum contribution to an Educational Savings Account is $2,000 which is phased out for high-income individuals.The contributions to a Section 529 Plan may be larger than $2,000 and are not phased out for high-income individuals.

C) Distributions from Section 529 Plans are non-taxable if used for qualified education expenses.The Educational Savings Account distribution is taxable on the earnings portion of the distribution even if used for qualified education expenses.

D) An Educational Savings Account income exclusion for distributions may be available in the same year as an education credit is claimed,but not if distributions from a Section 529 Plan are also taken.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

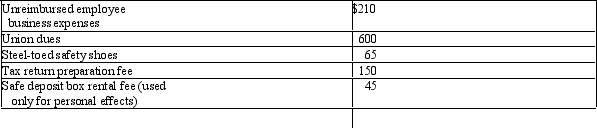

Polly is a telephone service person employed by a telephone repair firm.During 2011,she paid the following miscellaneous expenses:  If Polly were to itemize her deductions in 2011,what amount could she claim as miscellaneous itemized deductions (before applying the 2 percent of adjusted gross income limitation) ?

If Polly were to itemize her deductions in 2011,what amount could she claim as miscellaneous itemized deductions (before applying the 2 percent of adjusted gross income limitation) ?

A) $1,070

B) $1,025

C) $960

D) $875

E) $810

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

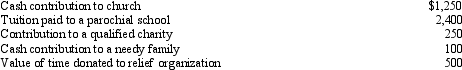

For 2011,Till and Larry had adjusted gross income of $30,000.Additional information for 2011 is as follows:  What is the maximum amount that they can use as a deduction for charitable contributions for 2011?

What is the maximum amount that they can use as a deduction for charitable contributions for 2011?

A) $1,250

B) $1,500

C) $1,600

D) $2,100

E) None of the above.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is not true about the higher education expense deduction?

A) Taxpayers are allowed an "above-the-line" deduction.

B) The total amount of qualified tuition and related expenses must be reduced by the excludable interest from higher education savings bonds.

C) The deduction is allowed for qualified expenses paid during the tax year for an academic term beginning within the first 3 months of the next tax year.

D) The deduction is always $4,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

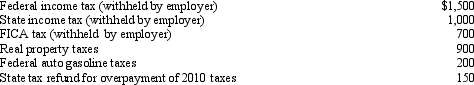

During 2011,Geraldine,a salaried taxpayer,paid the following taxes which were not incurred in connection with a trade or business:  What amount can Geraldine claim for 2011 as an itemized deduction for the taxes paid,assuming she elects to deduct state and local taxes?

What amount can Geraldine claim for 2011 as an itemized deduction for the taxes paid,assuming she elects to deduct state and local taxes?

A) $4,150

B) $1,950

C) $1,000

D) $1,750

E) $1,900

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current year,Carl and Jill incurred acquisition debt on their residence of $1,250,000.They also took out a home equity loan for $175,000.On a joint tax return,what is the amount of their qualified acquisition debt and qualified home equity debt,respectively?

A) $900,000 and $100,000

B) $1,000,000 and $0

C) $1,000,000 and $100,000

D) $1,250,000 and $175,000

E) $1,000,000 and $175,000

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a true statement about itemized deductions?

A) Medical expenses are allowed as itemized deductions only to the extent that they exceed 7.5 percent of AGI.

B) Miscellaneous deductions for gambling losses to the extent of gambling winnings are not subjected to the usual 2 percent of AGI floor ordinarily used for miscellaneous deductions such as tax preparation fees,investment expenses and job hunting expenses.

C) Personal casualty losses are only allowed as itemized deductions if they exceed 20 percent of the taxpayer's AGI.

D) Property taxes on second residences are deductible as itemized deductions.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

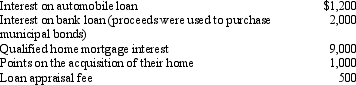

Janet and Andrew paid the following amounts during 2011:  What is the maximum amount they can use as interest expense in calculating itemized deductions for 2011?

What is the maximum amount they can use as interest expense in calculating itemized deductions for 2011?

A) $13,700

B) $12,500

C) $12,000

D) $10,000

E) $9,000

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following taxes are deductible on Schedule A?

A) Gasoline taxes not considered a "sales tax".

B) Trash collection fees.

C) Smog abatement fee of $20 per car on the renewal of the vehicle license.

D) Arizona State income taxes paid in 2011 for the 2010 tax year.

F) B) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

During 2011,Mary,a single taxpayer,had $3,750 of interest expense from a qualified education loan.Mary's modified adjusted gross income was $52,000.How much of the $3,750 is deducted for adjusted gross income?

A) $0

B) $2,000

C) $2,500

D) $3,750

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Please choose the true statement.

A) A charitable contribution may be deducted on Schedule A for donations to the mayor's campaign.

B) A taxpayer may deduct the value of a car donated to charity,but may not claim a deduction greater than the amount for which the charity actually sells the vehicle.

C) Generally,if charitable contributions are greater than the 50 percent adjusted gross income limitation,they can be carried back 2 years and then forward 5 years.

D) Raffle tickets for a church drawing are deductible.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not deductible as an itemized deduction?

A) Interest on a $300,000 mortgage used to purchase a principal residence.

B) Expenses for moving household goods.

C) A $1,000 contribution to the Heart Association by a taxpayer with $50,000 of AGI.

D) Property taxes on land held for investment in North Carolina by a California resident.

E) A personal casualty loss exceeding 10 percent of the taxpayer's AGI plus $100.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following expenses are deductible as a medical expense?

A) Travel to the seaside to improve the taxpayer's health.

B) An actress's lip-enhancing surgery.

C) Motorized wheel chair.

D) Non-prescription cough syrup recommended by the doctor.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 21

Related Exams