B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true regarding promissory notes?

A) Promissory notes are not shown at net realizable value on the statement of financial position.

B) Promissory notes are usually interest-bearing.

C) Promissory notes give a stronger legal claim to the holder than accounts receivable.

D) Promissory notes are frequently accepted from customers who need to extend the payment of an outstanding account receivable.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debit balance in the Allowance for Doubtful Accounts

A) is the normal balance for that account.

B) indicates that actual bad debt write-offs are higher than previous provisions for bad debts.

C) indicates that actual bad debt write-offs have been less than what was estimated.

D) cannot occur if the percentage of receivables method of estimating bad debts is used.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Allowance for Doubtful Accounts is credited when an account is determined to be uncollectible.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The receivables turnover ratio is used to analyze

A) profitability.

B) liquidity.

C) risk.

D) solvency.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the allowance method of accounting for uncollectible accounts, Bad Debts Expense is debited

A) when a credit sale is past due.

B) at the end of each accounting period.

C) whenever a pre-determined amount of credit sales have been made.

D) when an account is determined to be uncollectible.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The two accounting problems with accounts receivable are: (1) recognizing and (2) disposing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the allowance method for uncollectible accounts, the net realizable value of receivables is the same both before and after an account has been written off.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Receivables might be sold to

A) lengthen the cash-to-cash operating cycle.

B) take advantage of deep discounts on the net realizable value of receivables.

C) generate cash quickly.

D) finance companies at an amount greater than net realizable value.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The maker of a promissory note is the party to whom the payment is to be made.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions Under the aging of a company's accounts receivable, the uncollectible accounts are estimated to be $24,000. The unadjusted balance for the Allowance for Doubtful Accounts is $8,000 credit. -What is the balance in the Allowance for Doubtful Accounts account after adjustment?

A) $32,000

B) $24,000

C) $16,000

D) $ 8,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bad Debts Expense is reported on the income statement as

A) part of cost of goods sold.

B) an expense subtracted from gross sales to determine net sales.

C) an operating expense.

D) a non-operating expense.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a subsidiary ledger and a control account are used, each journal entry that affects accounts receivable must be posted twice.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net amount expected to be received in cash from receivables is termed the

A) net realizable value.

B) fair value.

C) gross cash value.

D) cash-equivalent value.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Under the allowance method for uncollectible accounts, bad debts expense is not recorded until a customer defaults.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to record a credit card sale using a nonbank credit card (e.g., Canadian Tire or Sears) includes a debit to the

A) Cash account.

B) Accounts Receivable account.

C) Debit Card Expense account.

D) Sales account.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The collection of an account that had been previously written off under the allowance method for uncollectible accounts

A) will increase profit in the period it is collected.

B) will decrease profit in the period it is collected.

C) requires a correcting entry for the period in which the account was written off.

D) does not affect profit in the period it is collected.

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

True/False

A note receivable is a written promise by the maker to the payee to pay a specified amount of money at a definite time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the allowance method is used to account for uncollectible accounts, Bad Debts Expense is debited when

A) a sale is made.

B) an account becomes uncollectible and is written off.

C) management estimates the amount of uncollectible accounts.

D) a customer's account becomes past due.

F) A) and C)

Correct Answer

verified

C

Correct Answer

verified

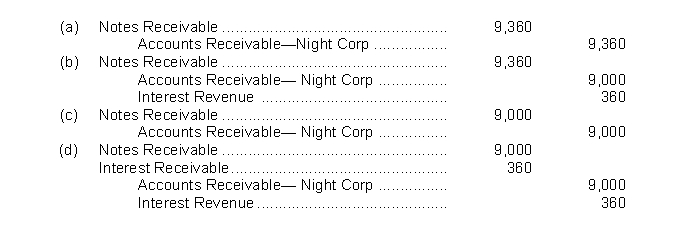

Short Answer

Day Corp receives a $9,000, 8-month, 6% note from Night Corp in settlement of a past due account receivable. What entry will Day Corp make upon receiving the note?

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 132

Related Exams