A) Useful life, property classification, and recovery period

B) Accounting convention, useful life, and property classification

C) Accounting convention, useful life, and recovery period

D) Accounting convention, property classification, and recovery period

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement concerning class life and recovery period is not true?

A) The class life of an asset and its recovery period under the Alternative Depreciation System (ADS) are generally the same.

B) Except for very short-lived property, the recovery period of an asset under MACRS is generally less than its class life.

C) A class life has been assigned by the IRS to each asset to which a recovery period has been assigned.

D) The class life of an asset is constant, regardless of which straight-line method is used to calculate its depreciation.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

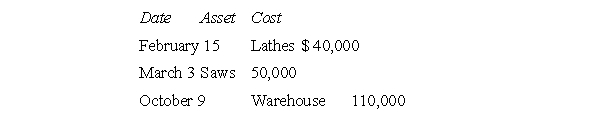

During the year, Fine Furnishings, a manufacturer of furniture, purchased the following assets:  In computing depreciation of these assets, which of the following conventions will be used?

In computing depreciation of these assets, which of the following conventions will be used?

A) Half-year, mid-month

B) Mid-quarter, mid-month

C) Half-year, mid-quarter, mid-month

D) Mid-quarter

E) Some combination other than those given above

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

All methods of depreciation permitted by the IRS prior to the 1981 introduction of ACRS provided taxpayers the opportunity to manipulate the depreciation deduction by underestimating the useful lives of their property.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Expenditures for research and experimentation that are deferred must be amortized ratably over a period of 17 years.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

In November of this year, Creative Corn Products, a calendar year taxpayer, placed in service its only equipment purchased during the year.The equipment cost $700,000.All of the equipment qualified as five-year property under MACRS.Ignore bonus depreciation.The maximum deduction that the taxpayer may claim with respect to the equipment is

A) $35,000

B) $87,500

C) $125,000

D) $240,000

E) $140,000

G) B) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Due to the ceiling on the amount of first-year expensing and depreciation deductions that may be claimed for automobiles, the basis of a car

A) Is fully recovered in less time than is that of a car costing less

B) Is fully recovered in the same amount of time as that of a car costing less

C) Is fully recovered in more time than is that of a car costing less

D) Is never fully recovered

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which property is depreciable using MACRS?

A) Manufacturing equipment purchased new

B) Automobiles used in a business

C) Apartment building purchased from a previous, unrelated owner

D) Computers used in a business

E) All of the above are depreciable using MACRS.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxpayer K purchased a used stereo system for $12,000 in May.K uses the system 20 hours each week for her business as a music critic, and she and her family use it 30 hours each week for educational and personal purposes.How much may K claim in deductions for depreciation and current expenses associated with the system? (Assume that stereo equipment has a recovery period of five years, regardless of the depreciation method employed.)

A) $0 depreciation, $0 expensed

B) $80 depreciation, $4,000 expensed

C) $0 depreciation, $4,800 expensed

D) $480 depreciation, $0 expensed

E) $960 depreciation, $0 expensed

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The keeping of records required for listed property is extensive but not limitless.What is not required to substantiate the use of listed property?

A) The date of use

B) The amount of each business use

C) The amount of each nonbusiness use

D) The amount of total use

E) The amount of each expenditure related to the property

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is not true of straight-line depreciation under MACRS?

A) Each of the three accounting conventions (half-year, mid-month, and mid-quarter) are eligible for MACRS straight-line depreciation.

B) MACRS straight-line depreciation is required for real property.

C) MACRS straight-line depreciation must be used for either all or none of the assets of a given class placed in service during a given year.

D) The class life of an asset is used as its recovery period.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Riverview Incorporated, a calendar year taxpayer, purchased an apartment building on June 1 last year for $1,200,000, of which $200,000 was allocable to the land.The corporation sold the property on June 27 of the current year.The corporation's depreciation for the building for the current year will be approximately

A) $0

B) $16,665

C) $18,180

D) $36,360

E) None of the above

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The use of MACRS is precluded for property placed in service prior to the enactment of either version of MACRS, unless the property is transferred in a transaction where both the owner and the user change.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

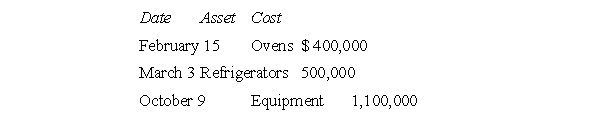

During the year a calendar year taxpayer, Heavenly Hamhocks, a chain of specialty food shops, purchased equipment as follows:  Assuming the property is all seven-year property, depreciation for the assets this year would be

Assuming the property is all seven-year property, depreciation for the assets this year would be

A) $71,400

B) $264,270

C) $285,800

D) $500,000

E) None of the above

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the year, T purchased the items shown below.Indicate which item qualifies for both § 179 limited expensing and bonus depreciation.

A) A new computer used to monitor his investments

B) A new office building to be used in his business

C) A truck purchased from XYZ Corporation, which had used it in its sand and gravel business

D) New office furniture for the new office building

E) None of the above

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The straight-line method must be used for amortizing intangible property such as copyrights.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not considered eligible property for limited expensing under § 179?

A) Automobile used by a salesman

B) Warehouse purchased by XYZ Corporation to store inventory

C) Computer used by Nick Knight to do the accounting for his video tape rental business

D) Equipment used by Serendipity Tea Company in its operations

E) All of the above are eligible.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year, Taxpayer N purchased a car for $12,000 and used it entirely for his construction business.Depreciation that year was $2,400.N hired his son T in February of the current year and allowed him to put the car to personal use on weekends.The value of T's personal use of the car was included as part of his income.If T's personal use of the car this year represented 60 percent of its total use, what income and depreciation expense related to the car should N include on the tax return for his business?

A) $0 income, $960 depreciation

B) $0 income, $1,920 depreciation

C) $1,200 income, $960 depreciation

D) $1,200 income, $1,920 depreciation

E) $2,400 income, $0 depreciation

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Personal property is

A) Not depreciable

B) Depreciable using the 150 percent declining-balance and 200 percent declining-balance methods only

C) Depreciable using the 150 percent declining-balance, 200 percent declining-balance, and straight-line methods

D) Depreciable using only those methods available for real property

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A depreciation deduction may be claimed for a decline in value that occurred while an item of property was held for personal purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 48

Related Exams