Correct Answer

verified

Working capital is the excess of total c...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

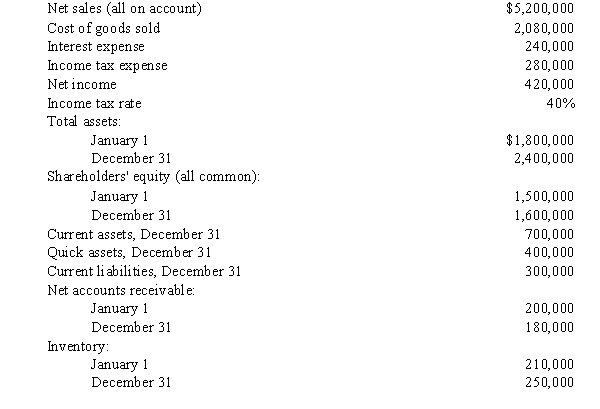

Exhibit 4-1

Given the following information for Blue Bell Company for last year:  -Refer to Exhibit 4-1. Blue Bell's inventory turnover for the year was

-Refer to Exhibit 4-1. Blue Bell's inventory turnover for the year was

A) 9.0 times

B) 8.3 times

C) 12.0%

D) 11.1%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Derivative financial instruments must be reported as either assets or liabilities on the balance sheet and be measured at their net realizable value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A component of equity that arises when a parent company owns a majority of the common shares of a subsidiary company is known as

A) majority interest.

B) noncontrolling interest.

C) earned capital.

D) unearned capital.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Financial leverage is measured by the debt-to-assets ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount a company would pay to acquire an asset it now holds is the asset's

A) historical cost.

B) current replacement cost.

C) current exit value.

D) present value.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Information about a company's operating capability may be helpful to external users in

A) assessing the uncertainty of its future cash flows.

B) evaluating the timing of cash flows in the near future.

C) evaluating the efficiency with which the company uses its resources to generate revenue.

D) assessing a return of investment as well as a return on investment.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary attribute of all assets is

A) service potential.

B) productive capacity.

C) historical cost.

D) service contribution.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Trademarks or acquired brand names are not amortized but are reviewed annually for impairment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The systematic allocation of the costs of natural assets to expense is called

A) amortization.

B) depreciation.

C) impairment.

D) depletion.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability of a company to adapt its resources to create change and react to change is called

A) financial flexibility.

B) return on investment .

C) operating capability.

D) risk .

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a component of contributed capital?

A) Preferred stock

B) Treasury stock

C) Earned capital

D) Additional paid-in capital

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A comparison of a company's performance with that of its competitors is known as

A) common-size analysis.

B) intercompany comparison.

C) ratio analysis.

D) intracompany comparison.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following elements is not recognized on the balance sheet?

A) Equity

B) Expense

C) Liability

D) Asset

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Time-series analysis is the same as rate of change analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A balance sheet account that is usually reported at present value is

A) Land.

B) Note Payable.

C) Accounts Payable.

D) Inventory.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the term for the systematic allocation of the costs of intangible assets to expense?

A) Amortization

B) Depreciation

C) Impairment

D) Depletion

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The SEC requires disclosure of quarterly high and low market prices for

A) two years.

B) three years.

C) four years.

D) The SEC does not require disclosure of quarterly high and low market prices.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Net realizable value is the amount a company would have to pay currently to acquire an asset it now holds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current liabilities includes all of the following except

A) income tax payable.

B) mortgage due to be paid this year.

C) notes receivable.

D) advance payments from customers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 127

Related Exams