A) an increase in the general level of prices.

B) trade restrictions that favor domestic industries over foreign competition.

C) an increase in the availability of goods and services that people value.

D) government subsidies that expand employment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will make it difficult to institute fiscal policy in a stabilizing manner?

A) Politicians will find it more attractive to raise taxes than to increase spending.

B) Politicians will find it attractive to increase taxes during a recession,but they will be reluctant to reduce them during an expansion.

C) Politicians will find budget deficits attractive during a recession,but they will be reluctant to run budget surpluses during an expansion.

D) Politicians will find budget surpluses attractive during a recession,but they will be reluctant to run budget deficits during an expansion.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

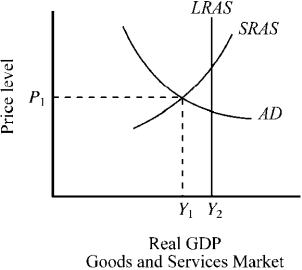

Use the figure below to answer the following question(s) .

Figure 12-1

-Refer to Figure 12-2.Which of the following will most likely be favored by a new classical economist if the economy is operating at point a?

-Refer to Figure 12-2.Which of the following will most likely be favored by a new classical economist if the economy is operating at point a?

A) a tax increase to balance the budget

B) restrictive fiscal policy

C) expansionary fiscal policy

D) continuation of the current tax and expenditure policies (dependence on the economy's self-correcting mechanism to restore full employment)

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Japanese experience during the 1990s indicates that

A) budget deficits will promote recovery,but it may take as much as two years for them to be effective.

B) increases in government expenditures financed by borrowing may not promote recovery.

C) increases in government expenditures financed by borrowing will promote recovery.

D) substantial budget surpluses will help promote recovery.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true with regard to the use of countercyclical fiscal policy as a stabilization tool?

A) Successful fiscal policy would be easy to achieve if Congress had greater access to forecasting tools.

B) Successful fiscal policy is difficult to achieve because Congress acts slowly and our ability to predict the future is limited.

C) Successful fiscal policy is easier to achieve today because econometric forecasting models are highly accurate.

D) Congress and the President have persistently altered fiscal policy in a stabilizing manner.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If decreased government borrowing drives down real interest rates in the United States,

A) private investment will tend to decline.

B) the dollar will depreciate leading to an increase in net exports.

C) an inflow of capital will cause the dollar to depreciate.

D) All of the above are true.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a fiscal policy change is going to exert a stabilizing impact on the economy,it must

A) add demand stimulus during a slowdown but restraint during an economic boom.

B) exert an expansionary impact during all phases of the business cycle.

C) restrain aggregate demand during all phases of the business cycle.

D) keep the government's budget in balance.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The modern synthesis view of fiscal policy stresses

A) how easy it is to time fiscal policy changes so they exert a stabilizing influence on the economy.

B) the ineffectiveness of fiscal policy,even during periods of widespread unemployment.

C) the difficulties involved in timing fiscal policy changes so they will exert a stabilizing impact on the economy.

D) that automatic stabilizers do not help smooth fluctuations in the economy.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Increases in government expenditures and large budget deficits are projected for 2010-2019.If strong growth is observed during this decade,this would be most consistent with

A) the Keynesian view.

B) the supply-side view.

C) the crowding-out effect.

D) the new classical theory.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expansionary effects of an increase in government expenditures will tend to be offset,at least partially,if

A) government borrowing drives interest rates upward.

B) taxes are not also increased.

C) business decision makers and consumers become more optimistic as the result of the fiscal stimulus.

D) the economy is operating well below its full-employment capacity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things being constant,countries with higher rates of saving

A) will have smaller GDPs than countries with lower rates of saving.

B) will have higher rates of investment,but slower growth.

C) will have higher rates of investment and growth.

D) will be operating at less than full employment and potential output.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true?

A) The expansionary fiscal policy of the 1980s stimulated aggregate demand and led to high rates of inflation during the latter half of the decade.

B) The restrictive fiscal policy of the 1990s led to sluggish economic growth during the decade.

C) Even though fiscal policy was highly expansionary during the 1980s,the inflation rate fell and remained at relatively low levels.

D) Even though fiscal policy was restrictive during the 1990s,the real growth rate of the economy was strong.

E) Both c and d are true.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in subsidies and other government spending during a recession is likely to result in

A) an increase in rent-seeking activity.

B) an increase in productive projects and a reduction in unproductive projects.

C) a decrease in the level of future taxes.

D) greater reliance on profits and losses in the allocation of resources.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a potential drawback of an expansion of government spending projects during a recession?

A) Spending projects are easily reversed once the economy has recovered.

B) Government spending projects are not included in the calculation of GDP.

C) Those benefiting from spending projects will lobby for a continuation of these projects long after the economy has recovered.

D) Government spending projects will not encourage rent-seeking activity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is an increase in foreign financial investment in the United States as the result of large U.S.budget deficits and attractive interest yields,

A) fiscal policy will be more expansionary since there will be no crowding-out effect.

B) fiscal policy will be more expansionary since U.S.residents will increase their savings,so they can repay the foreigners in the future.

C) foreign exchange value of the dollar will depreciate,which will lead to an increase in net exports and aggregate demand.

D) foreign exchange value of the dollar will appreciate,which will lead to a decrease in net exports and aggregate demand.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The new classical model implies that a

A) budget surplus will effectively retard inflation emanating from excess demand.

B) budget deficit will increase the real interest rate.

C) substitution of debt for tax financing will leave aggregate demand and real output unchanged.

D) planned budget deficit will be a highly effective tool to combat a recession.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Keynesian view,expansionary fiscal policy will have its greatest impact

A) when planned aggregate expenditures equal total output.

B) during a strong economic expansion.

C) when widespread unemployment is present.

D) during a period of severe inflation.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When household debt as a share of income is abnormally high,

A) rapid growth of consumption is likely to lead the recovery.

B) the growth prospects of the economy will be excellent because high household debt is the key to a strong economy.

C) the growth of consumption is likely to remain sluggish even as the economy begins to recover.

D) consumers will be in a strong position to deal with irregular expenses.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When resources are allocated politically,rent-seeking will

A) channel resources toward government programs that generate large benefits relative to costs.

B) reduce GDP because it results in the wasteful use of resources.

C) lead to wasteful,rather than productive,use of resources.

D) improve the efficiency of resource use.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Between 1986 and 2010,the top marginal personal income tax rate was 40 percent or less compared to 70 percent or more prior to 1981.Compared to the earlier time period,in recent years the share of personal income taxes paid by high income taxpayers

A) has been lower.

B) has been virtually unchanged.

C) has been higher.

D) increased in the late 1980s,but has been falling ever since.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 171

Related Exams