A) $4,500

B) $50,000

C) $51,500

D) $54,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the terms to the definitions. a.authorized shares i.stock option b.issued shares j.stock warrant c.outstanding shares k.treasury stock d.par value l.call provision e.stated capital (legal capital) m.earnings per share f.preemptive right n.dividend yield ratio g.retained earnings o.dividend payout ratio h.stock split -Accumulated net income of the corporation that has not been distributed as dividends.

Correct Answer

verified

Correct Answer

verified

True/False

Dividend-related dates follow this chronological order: declaration date, record date, and payment date.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a corporation makes a cash distribution despite having no retained earnings, this is called a

A) dividend in arrears.

B) call provision.

C) conversion privilege.

D) liquidating dividend.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

To compute the return on common equity ratio, the numerator includes ____________________ minus preferred dividends, and the denominator is the average common stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

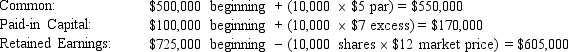

-Refer to Lakeshore Industries. What is the effect of a 10% stock dividend if the market price of the common stock is $30 per share when the stock dividend is declared?

-Refer to Lakeshore Industries. What is the effect of a 10% stock dividend if the market price of the common stock is $30 per share when the stock dividend is declared?

A) A stock dividend has no impact on any of the stockholders' equity accounts.

B) Total stockholders' equity increases $75,000.

C) Cash increases $300,000.

D) $225,000 of retained earnings is transferred to the capital stock accounts.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Comprehensive income represents the increase in net assets resulting from all transactions occurring during the accounting period except transactions with owners.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company plans to distribute $134,000 in dividends. It has outstanding 200,000 shares of 7% $10 par preferred stock (non-cumulative and non-participating) and 60,000 shares of $2 par common stock. How much will be distributed per share on preferred and common stock? Preferred stock Common stock

A) $0.52 $0.52

B) $0.67 $0.00

C) $0.00 $2.23

D) $0.60 $2.00

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Large corporations are profitable enough to maintain their own stockholder lists and arrange for the issuance of their stock certificates to stockholders rather than having to retain an independent stock transfer agent to do those things.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a corporation issues cumulative, participating preferred stock, which of the following is true regarding the rights of the preferred stockholders?

A) They must forego dividends for any periods when no dividends are declared.

B) They will share in the dividends that exceed a specified amount.

C) They will received a fixed dividend regardless of the amount of dividends declared.

D) They will have an option to convert their shares to common stock at a specified date.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Both stock dividends and stock splits increase the number of a corporation's outstanding shares without altering the proportionate ownership of the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A corporate charter is sometimes called the articles of incorporation.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

An electric utility issued 3,000 shares of common stock, all of the same class; 2,800 shares are outstanding and 200 are held in the treasury. On August 15, 2015, the board of directors declared a cash dividend of $2.10 per share, payable on September 15, 2015, to stockholders of record on August 31, 2015. Prepare the required journal entries for August 15, August 31, and September 15.

Correct Answer

verified

Correct Answer

verified

True/False

When computing earnings per share, the numerator includes net income minus any dividends paid to common stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

No formal journal entry is required to record a stock split.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a corporation pays a previously declared cash dividend, which of the following is true?

A) cash increases

B) liabilities decrease

C) stockholders' equity decreases

D) no entry is necessary

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A growing corporation had $180,000 of its $30 par common stock issued before its recent 3-for-1 stock split. The market price of the stock was $120 per share before the split. Which of the following is true as a result of the split?

A) There were 24,000 shares (6,000 + 18,000) of common stock issued after the split.

B) The balance in the common stock account increased to $540,000.

C) The market price of the stock tripled.

D) The par value of the stock decreased to $10 per share.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the terms to the definitions. a.authorized shares i.stock option b.issued shares j.stock warrant c.outstanding shares k.treasury stock d.par value l.call provision e.stated capital (legal capital) m.earnings per share f.preemptive right n.dividend yield ratio g.retained earnings o.dividend payout ratio h.stock split -The maximum number of shares the corporation may issue in each class of stock.

Correct Answer

verified

Correct Answer

verified

Essay

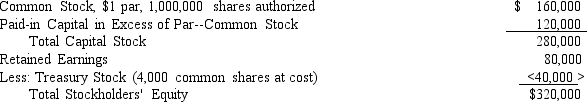

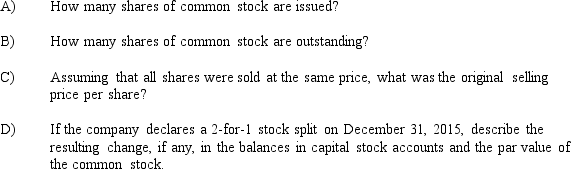

The following information comes from a balance sheet at December 31, 2015:

Answer the following questions:

Answer the following questions:

Correct Answer

verified

Correct Answer

verified

True/False

A stock option is the same as a stock warrant.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 242

Related Exams