A) The total amount of depreciation expense recognized over the six-year useful life will be greater under the double-declining-balance method than the straight-line method.

B) The amount of depreciation expense recognized in Year 4 would be greater if Dinwiddie depreciates the car under the straight-line method than if the double-declining-balance method is used.

C) At the end of Year 2, the amount in accumulated depreciation account will be less if the double-declining-balance method is used than it would be if the straight-line method is used.

D) None of these statements is true.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goodwill may be recorded in which of the following circumstances?

A) When the property, plant and equipment of a business increase in value

B) When a business earns a very high net income

C) When a business sells property for more than its book value

D) When one business acquires another business

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On March 1,Bartholomew Company purchased a new stamping machine with a list price of $34,000.The company paid cash for the machine; therefore,it was allowed a 5% discount.Other costs associated with the machine were: transportation costs,$550; sales tax paid,$1,360; installation costs,$450; routine maintenance during the first month of operation,$500.What is the cost of the machine?

A) $34,210

B) $32,300

C) $35,160

D) $34,660

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,the City Taxi Company purchased a new taxi cab for $36,000.The cab has an expected salvage value of $2,000.The company estimates that the cab will be driven 200,000 miles over its life.It uses the units-of-production method to determine depreciation expense.The cab was driven 45,000 miles the first year and 48,000 the second year.What is the amount of depreciation expense reported on the Year 2 income statement and the book value of the taxi at the end of Year 2,respectively?

A) $8,640 and $19,260

B) $8,640 and $17,260

C) $8,160 and $20,190

D) $8,160 and $18,190

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When using the modified accelerated cost recovery system (MACRS)the highest amount of depreciation expense will be recognized in the year the asset is acquired.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Farmer Company purchased machine on January 1, Year 1 for $82,000. The machine is estimated to have a 5-year life and a salvage value of $4,000. The company uses the straight-line method. -On January 1,Year 1,Ballard company purchased a machine for $52,000.On January 1,Year 2,the company spent $12,000 to improve its quality.The machine had a $4,000 salvage value and a 6-year life,which are unchanged.Ballard uses the straight-line method.What is the book value of the machine on December 31,Year 4?

A) $24,800

B) $20,800

C) $10,400

D) $24,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true regarding depreciation expense?

A) Different companies in the same industry always depreciate similar assets by the same methods.

B) A company using the straight-line method will show a smaller book value for assets than if the same company uses the double-declining-balance method.

C) Choosing the double-declining balance method over the straight-line method will produce a greater total depreciation expense over the asset's life.

D) A company should use the depreciation method that best matches expense recognition with the use of the asset.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false.

Correct Answer

Multiple Choice

On January 1,Year 1,Stiller Company paid $80,000 to obtain a patent.Stiller expected to use the patent for 5 years before it became technologically obsolete.The remaining legal life of the patent was 8 years.Based on this information,what is the amount of amortization expense during Year 3 and the book value of the patent as of December 31,Year 3,respectively?

A) $10,000 and $30,000

B) $16,000 and $48,000

C) $10,000 and $50,000

D) $16,000 and $32,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For Year 1,Oscar Company records depreciation expense of $12,000 on its income statement and $9,000 of MACRS depreciation on its tax return.Which of the following answers is correct regarding the difference between the two figures?

A) Net income is understated by $3,000 on the Year 1 income statement.

B) Deferred taxes of $3,000 are subtracted from taxable income of Year 1.

C) The difference in depreciation expense is caused by differences between GAAP and the tax code.

D) The amount of depreciation recorded on the income tax return must be incorrect.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Generally accepted accounting principles require that,when the estimated useful life of a long-term asset is changed,previously-issued financial statements should not be revised.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

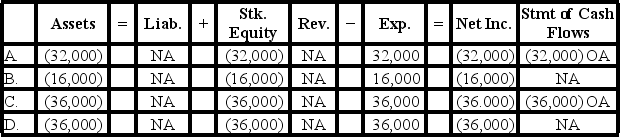

Flagler Company purchased equipment that cost $90,000.The equipment had a useful life of 5 years and a $10,000 salvage value.Flagler uses the double-declining-balance method.Which of the following choices accurately reflects how the recognition of the first year's depreciation would affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

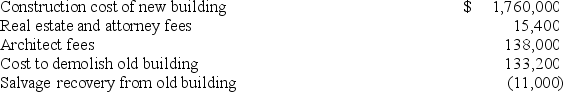

On January 6,Year 1,Mount Jackson Corporation purchased a tract of land for a factory site for $1,500,000.An existing building on the site was demolished and the new factory was completed on October 11,Year 1.Additional cost data are shown below:

Which of the following are the capitalized costs of the land and the new building,respectively?

Which of the following are the capitalized costs of the land and the new building,respectively?

A) $1,637,600 and $1,898,000

B) $1,515,400 and $2,020,200

C) $1,648,600 and $1,887,000

D) $1,500,000 and $2,035,600

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false.

Correct Answer

True/False

Land differs from other property because it is not subject to depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following industries would most likely have the highest value for the ratio of sales to property,plant,and equipment?

A) Airline

B) Consumer product manufacturing company

C) Electric utility

D) Stock brokerage

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Matching

Ernie Company acquired Bert Company in January of Year 1.Bert's balance sheet included $700,000 of assets,$250,000 of liabilities and stockholders' equity of $450,000.Ernie agrees to assume the liabilities and pay $480,000 to acquire Bert.An independent appraiser assessed the fair value of Bert's assets to be $630,000.Indicate whether each of the following statements about this transaction is true or false.

Correct Answer

True/False

An expenditure that improves the quality of service provided by a plant asset is added to the historical cost of the asset.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The depreciable cost of a long-term asset is the difference between the amount paid for the asset and its salvage value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anchor Company purchased a manufacturing machine with a list price of $160,000 and received a 2% cash discount on the purchase.The machine was delivered under terms FOB shipping point,and transportation costs amounted to $2,400.Anchor paid $3,000 to have the machine installed and tested.Insurance costs to protect the asset from fire and theft amounted to $3,600 for the first year of operations.What is the cost of the machine?

A) $156,800

B) $159,200

C) $165,800

D) $162,200

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 122

Related Exams