A) Wholesale firm

B) Service firm

C) Retail firm

D) Consulting firm

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Assume the perpetual inventory system is used. 1) Green Company purchased merchandise inventory that cost $64,000 under terms of 2/10, n/30 and FOB shipping point. 2) Green Company paid freight cost of $2,400 to have the merchandise delivered. 3) Payment was made to the supplier on the inventory within 10 days. 4) All of the merchandise was sold to customers for $94,000 cash and delivered under terms FOB destination with freight cost amounting to $1,600. -What is the amount of gross margin that results from these transactions?

A) $31,280

B) $27,280

C) $28,880

D) $29,680

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Net sales is calculated by subtracting cost of goods sold from sales revenue.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Gross margin is equal to the amount of change (increase or decrease)in Merchandise Inventory during a period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

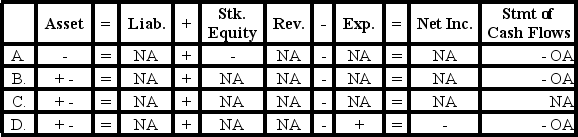

A company using the perpetual inventory system paid cash for freight costs to purchase merchandise.Which of the following reflects the effects of this event on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Net income is not affected by a purchase of merchandise.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data is from the income statement of Ralston Company: What is the company's gross margin percentage?

A) 66.67%

B) 25.93%

C) 60.00%

D) 15.60%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sam Company reported the following amounts on its income statement: Based on the information provided,what was the amount of sales reported on the income statement?

A) $700,000

B) $600,000

C) $300,000

D) $200,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

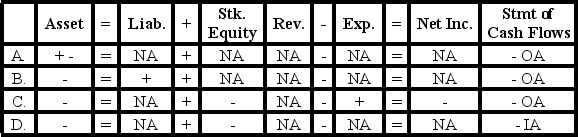

Leonard Company paid freight costs to have goods shipped to one of its customers.What effect will the payment of these freight costs have on the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A company using a perpetual inventory system treats transportation-out as an operating expense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What happens when merchandise is delivered FOB Destination?

A) The seller pays the freight cost.

B) The seller records transportation-out expense.

C) The buyer pays the freight cost.

D) The seller pays the freight cost and records an expense.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

SX Company sold merchandise on account for $16,000.The merchandise had cost the company $6,000.What is the effect of the sale on the income statement?

A) Revenue increases by $10,000.

B) Expenses increase by $6,000.

C) Net income increases by $16,000.

D) All of these answer choices are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

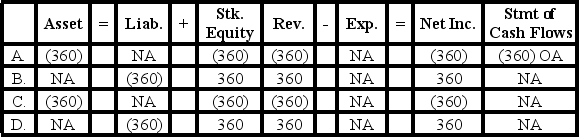

Howell Company granted a sales allowance of $360 to a customer who was not totally satisfied with the quality of goods received.The customer did not return the goods and had not yet paid for them.Which of the following reflects the effects of this event on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items is not a product cost?

A) Freight cost on goods delivered FOB destination to customers

B) Cost of merchandise purchased for resale

C) Transportation cost on merchandise purchased from suppliers

D) All of these answer choices are product costs

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using a perpetual inventory system,which of the following events is an asset use transaction?

A) Paid cash to purchase inventory

B) Paid cash for transportation-out costs

C) Purchased inventory on account

D) Paid cash for transportation-in costs

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

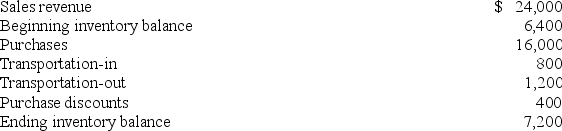

Sullivan Company uses the periodic inventory system.The following balances were drawn from the accounts of Sullivan Company prior to the closing process:

What is the gross margin that will be shown on the income statement?

What is the gross margin that will be shown on the income statement?

A) $8,400

B) $7,200

C) $15,600

D) $18,400

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

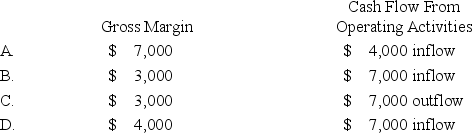

Flagler Company purchased $4,000 of merchandise on account.Flagler sold the merchandise to a customer for $7,000 cash.What is the increase in gross margin and the net change in cash flow from operating activities as a result of these transactions? (Consider the effects of both parts of this event.)

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current year,Gomez Co.had beginning inventory of $2,400 and ending inventory of $1,200.The cost of goods sold was $9,600.What is the amount of inventory purchased during the year?

A) $8,400

B) $9,600

C) $10,800

D) $13,200

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is the net income percentage calculated?

A) Net Sales divided by net Income

B) Net Income divided by net Sales

C) Total stockholders' equity divided by net sales

D) Net Income divided by Gross Margin

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

With a perpetual inventory system,the cost of merchandise inventory is recognized at the time of purchase.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 106

Related Exams