B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Each parcel of land in a new development is selling for $15,000 and the total project revenue is estimated to be $5,000,000.The project lender has stated that the loan should be paid off when 80% of the total project revenue has been earned.The total loan amount is $3,500,000.What is the release price for each parcel?

A) $8,400

B) $12,000

C) $12,750

D) $13,125

F) C) and D)

Correct Answer

verified

D

Correct Answer

verified

True/False

It is proper to include an estimate for developer profit as a cost of development when projecting net cash flows and evaluating whether a required rate of return will be met.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

By using an option contract,a developer may profit from an appreciation in the property's value over the option period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A lender does not usually require a developer to submit a schedule of estimated cash flows prior to approving a land development loan.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

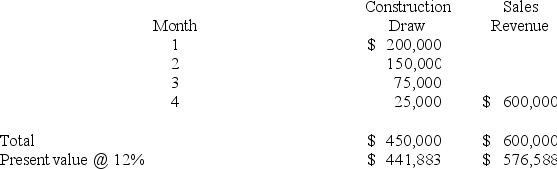

Consider the table,which summarizes monthly construction draws and sales revenues.What is the percentage of lot sales revenue that needs to be used to repay the loan?

A) 4.0%

B) 75.0%

C) 76.6%

D) 33.3%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The release schedule refers to a schedule of expiring leases for existing tenants.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following might impact the density of housing in a land development project?

A) The price paid for the land by the developer

B) The terrain of the land

C) The target market's preferences regarding density

D) All of the above

F) A) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Which of the following does NOT contribute to the complication of estimating the amount of interest carry?

A) The loan is taken down in draws and interest is calculated only as funds are drawn down

B) Revenue from each type of site varies

C) The rate of repayment of a loan depends on when the parcels are actually sold

D) Development loan interest rates are usually fixed while market rates fluctuate

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

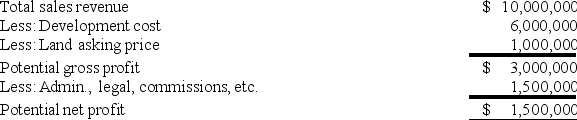

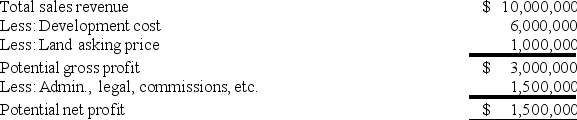

Consider the feasibility study shown in the table.What is the return on total cost for the proposed project?

A) 15.0%

B) 17.6%

C) 21.4%

D) 150.0%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When financing land development,the lender generally requires the developer to submit which of the following?

A) A detailed breakdown of project cost

B) Required zoning changes

C) Bank references for the general contractor to be used on the project

D) All of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally,which of the following is FALSE regarding interest rate risk management techniques?

A) Borrowers can protect themselves from upward movements in interest rates by using interest rate caps

B) Borrowers can protect themselves from upward movements in interest rates by using interest rate futures contracts

C) Borrowers can benefit from downward movements in interest rates by using interest rate caps

D) Borrowers can benefit from downward movements in interest rates by using interest rate futures contracts

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following costs should NOT be included in a net present value analysis of a land development project?

A) Land purchase price

B) Property tax

C) General overhead such as personnel costs

D) Developer's profit

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A developer must sell all of the lots in a development project and repay the entire development loan before any of the new property owners can receive a clear title.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The release price is the dollar amount of a loan that must be repaid when a lot is sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the MOST LIKELY sequence of events in the land development process?

A) Inspect site,perform feasibility analysis,implement marketing program,purchase land and begin construction of improvements

B) Inspect site,purchase land and begin construction of improvements,perform feasibility analysis,implement marketing program

C) Inspect site,perform feasibility analysis,purchase land and begin construction of improvements,implement marketing program

D) Purchase land,perform feasibility analysis,perform preliminary market study,begin construction of improvements,implement marketing program

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the feasibility study shown in the table.You have been advised that sales revenues may be 10 percent lower and/or development costs may be 10 percent higher.Performing a sensitivity analysis,you conclude:

A) A 10 percent decrease in sales revenues would have a bigger impact on returns than a 10 percent increase in development costs

B) A 10 percent increase in development costs would have a bigger impact on returns than a 10 percent decrease in sales revenues

C) A 10 percent increase in development costs and a 10 percent decrease in sales revenues would have opposite impacts on returns,canceling each other out and having no impact on returns

D) Both factors would have such a small impact,that there is no reason to be concerned about either a 10 percent increase in development costs or a 10 percent decrease in sales revenues

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A futures instrument,such as a T-bill,can be used to hedge a cash or a spot instrument such as the prime rate,where the two instruments are not perfectly correlated.What type of hedge is this referred to as?

A) A perfect hedge

B) A straight hedge

C) A cross hedge

D) None of the above

F) None of the above

Correct Answer

verified

C

Correct Answer

verified

True/False

A feasibility study analyzes whether a tract of land can be purchased and developed profitably.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Option contracts are used to reserve a parcel of land so that it will not be sold to someone else,while the developer does preliminary analysis of the site.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 35

Related Exams