A) private good.

B) natural monopoly.

C) open-access good.

D) public good.

E) quasi-private good.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An underground economy grows more when:

A) government regulations increase.

B) government regulations decrease.

C) government corruption decreases.

D) government spending increases.

E) tax rate decreases.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

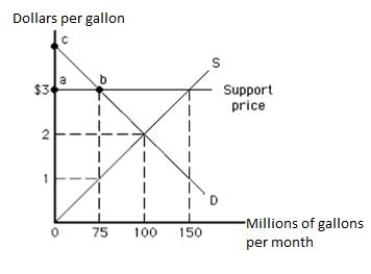

The following graph shows the market for milk. Suppose the government introduces a variety of policies that set floor prices for milk at $3. Without government intervention, the market price of milk would average $2 per gallon for a market quantity of 100 million gallons per month. In the graph below, triangle abc represents the consumer surplus at the support price.

Figure 16.1

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The median-voter model attempts to explain why:

A) law partners seldom agree on the division of costs.

B) the preferences of the typical voter often dominate other choices in a democracy.

C) democracies evolve into dictatorships.

D) people are largely oblivious to most public choices.

E) resources employed to persuade government to redistribute income and wealth to special interests are unproductive.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally, people are more satisfied with private market outcomes than with public voting outcomes because:

A) each consumer in the private market can choose the quantity he or she desires.

B) the marginal utility of the last unit of private good is always positive.

C) the prices of private goods are lower than those of public goods.

D) the utility derived from the consumption of private goods is higher than that from public goods.

E) there are too many choices to make in the public sector.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A study found that privately operated juvenile correction facilities in Florida had _____ costs but experienced _____ rates of recidivism than state-operated juvenile corrections facilities.

A) lower, higher

B) lower, lower

C) higher, equivalent

D) higher, lower

E) lower, equivalent

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a good that is nonrival and nonexclusive in consumption?

A) Televisions

B) Haircuts

C) Pizza

D) National defense

E) Tickets to a rock concert

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following federal budget allocations is an example of traditional public-goods legislation?

A) Funding for cancer research

B) Funding for the construction of a statue in Alabama

C) Provision of subsidies to wheat producers

D) Dealing with labor union issues

E) Implementation of tort reforms

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Filing a fraudulent income tax return that understates income or overstates deductions is known as:

A) tax evasion.

B) logrolling.

C) tax avoidance.

D) rent seeking.

E) profiteering.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Officials have estimated the size of the U.S. underground economy to be approximately _____ in 2012.

A) 6 to 8 percent of GDP

B) about $15 trillion

C) 1 percent of GDP

D) $60-80 billion

E) about $2 trillion

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the support price for a good is higher than the market equilibrium price, _____.

A) resources tend to flow to their lowest-valued use

B) the quantity of the good demanded by the consumers will increase

C) producer surplus enjoyed by the suppliers will decrease in the short run

D) the prices of specialized resources will decrease

E) consumer surplus will decrease

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Rent seeking is a zero-sum game because the public's loss is the rent seeker's gain.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Special-interest legislation generally leads to an increase in social welfare.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of populist legislation?

A) Legislation for the restoration of a historic theatre

B) The government setting a floor price on milk

C) Legislation for tort reforms

D) The government providing agricultural subsidies to farmers

E) Legislation for funding cancer research

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Rent-seeking behavior imposes no costs on society.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rent-seeking activities by special interest groups result in:

A) greater economic activity by promoting efficiency in government.

B) lower economic activity by diverting resources to less-productive or nonproductive uses.

C) a more equal distribution of income and wealth in the nation.

D) an increase in government revenue through an increase in taxes.

E) greater efficiency in the private economy and increased wealth for society.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government of Marina decides to pay for public radio by taxing people on the basis of the number of hours they listen to it. In order to determine the tax, it decides to conduct a survey. However, if the survey is based on voluntary self-reporting, which of the following is likely to happen?

A) People who report many hours of listening may pay a small proportion of their income in public radio tax.

B) Individuals with higher incomes may pay lower taxes than individuals with lower income.

C) Many individuals may understate the number of hours they listen to public radio to government in order to reduce their tax bill.

D) Many individuals may overstate the number of hours they listen to public radio to government in order to receive a lower tax bill.

E) In order to evade taxes, individuals may shift from the formal, reported economy to an underground, "off the books" economy.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Traditional public-goods legislation usually has a negative impact on the economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Direct transfer programs:

A) are generally less efficient and less politically acceptable than subsidy programs.

B) are generally more efficient and more politically acceptable than subsidy programs.

C) are generally less efficient but more politically acceptable than subsidy programs.

D) are generally more efficient but less politically acceptable than subsidy programs.

E) are generally less efficient as they benefit only the large farmers.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Taxpayers and consumers end up paying for agricultural price supports.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 150

Related Exams