B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following frauds refers to improper claims made for the reimbursement of business expenses?

A) False expense reimbursement fraud

B) Misleading expense reimbursement fraud

C) Fictitious expenses claim fraud

D) False claims fraud

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following payroll taxes do employers pay on employees?

A) SUTA

B) FUTA

C) FICA

D) All of these

E) None of these

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms that follow with the correct definitions. -An annual report filed by the employer and sent to the Social Security Administration showing wages, tips, and tax withholdings of the firm's employees

A) Form W-4

B) SUTA tax

C) Employee's individual earnings record

D) Worker's compensation insurance

E) Form 940

F) FICA Medicare

G) Form 941

H) FUTA tax

I) Form W-3

J) Form W-2

L) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The employer becomes liable for payroll tax expense when the employees are actually paid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

SUTA taxes are normally paid:

A) Annually

B) Quarterly

C) Monthly

D) Weekly

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Required employee payroll deductions include income taxes, FICA taxes, union dues, and charitable contributions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the payroll tax expense includes all of the following except

A) Federal Unemployment Tax Payable.

B) FICA Tax Payable.

C) Employees' Federal Income Tax Payable.

D) State Unemployment Tax Payable.

E) None of these are correct.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The 941 tax return form is reported ___________.

A) Semi-Weekly

B) Monthly

C) Quarterly

D) Annually

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

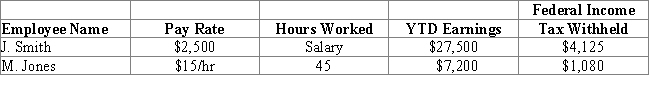

Colin Street Body Shop has the following information for the pay period ending March 31st: Assume the Following:

FICA-SS Tax Rate is 6.2%

FICA-Medicare Tax Rate is 1.45%

FUTA Tax Rate is 0.6% on the first $7,000 of wages paid

SUTA Tax Rate is 5% on the first $9,000 of wages paid

From the information provided above, what would be the amount of Wage Expense recorded?

FICA-SS Tax Rate is 6.2%

FICA-Medicare Tax Rate is 1.45%

FUTA Tax Rate is 0.6% on the first $7,000 of wages paid

SUTA Tax Rate is 5% on the first $9,000 of wages paid

From the information provided above, what would be the amount of Wage Expense recorded?

A) $712.50

B) $2,500.00

C) $3,175.00

D) $3,212.50

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms that follow with the correct definitions. -Tax form that represents the employer's annual unemployment tax return

A) Form W-4

B) SUTA tax

C) Employee's individual earnings record

D) Worker's compensation insurance

E) Form 940

F) FICA Medicare

G) Form 941

H) FUTA tax

I) Form W-3

J) Form W-2

L) C) and F)

Correct Answer

verified

Correct Answer

verified

True/False

Each employer subject to the federal unemployment tax must file an annual return and pay the unpaid portion of the tax by January 31 of the following year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Most employers are required to withhold federal unemployment taxes from employees' earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following insurance coverages is provided by the employers for employees killed or injured on the job?

A) Estate Compensation insurance

B) Disability Endurance insurance

C) Workers' Compensation Insurance

D) Property Assurance Insurance

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

FUTA tax liability is generally deposited _________ and reported ___________.

A) Weekly, Monthly

B) Monthly, Quarterly

C) Quarterly, Annually

D) Deposits and Report Dates Vary

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Payroll tax expense represents the amount of taxes contributed by the

A) employee.

B) employer.

C) employee and employer combined.

D) employer plus gross pay.

E) employer plus the employee's net pay.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary Jane's cumulative year-to-date earnings are $7,200. On June 30th, Mary Jane earned $600. What is the FUTA tax amount that Mary Jane's employer must record and pay on her most recent earnings?

A) $0

B) $4.80

C) $52.80

D) $56.00

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry required to record the employer paying the 941 payroll tax liability is:

A)

Employees' Federal

Income Tax Payable DR

FICA Taxes Payable DR

Cash CR

B)

C)

SUTA Payable DR

Cash CR

D)

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The details of the current week's earnings for each employee are reported on each employee's W-4 form.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement is true?

A) Payroll Tax Expense increases on the credit side of the account.

B) FICA Medicare Payable increases with a credit.

C) Federal Income Tax Withholding Payable decreases with a credit.

D) Employee Payroll Taxes withheld are recorded in Payroll Tax Expense.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 95

Related Exams