A) U.S.President.

B) Judiciary.

C) Congress.

D) International Monetary Fund.

E) State governments.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following monetary policies will increase money supply?

A) An increase in the discount rate

B) An increase in the reserve requirement

C) Open market purchases by the Fed

D) The Fed selling government bonds

E) An increase in the federal funds rate

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following people is most likely to demand U.S.dollars in the foreign exchange market?

A) A United States resident who is traveling to the Greek Islands

B) An American investor who intends to buy Japanese government bonds

C) A resident of Australia who is traveling to Belgium

D) A British importer of U.S.beef

E) A U.S.company that is importing avocados from Mexico

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the yen price of one U.S.dollar rises to 80 yen and that the Bank of Japan has a target exchange rate of 75 yen per dollar.As a result, the Bank of Japan will intervene in the foreign exchange market by:

A) selling U.S.dollars and buying yen.

B) selling both U.S.dollars and yen.

C) buying U.S.dollars and selling yen.

D) buying both U.S.dollars and yen.

E) buying U.S.Treasury securities.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Board of Governors is the body responsible for setting and implementing monetary policy targets for the Federal Reserve System.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Fed has set a uniform reserve requirement of 3 percent for all deposits in the U.S.banking system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a bond pays 11.5 percent interest a year and a bank deposit pays 3.5 percent, the opportunity cost of holding the deposit is:

A) 11.5 percent.

B) 15 percent.

C) 8 percent.

D) 3.5 percent.

E) 13.5 percent.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the current market price of a bond that pays $200 per year indefinitely and has a current yield of 16 percent?

A) $800

B) $1250

C) $3, 200

D) $8, 000

E) $12, 500

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose that the nominal money supply equals $2 billion and nominal GDP is $16 billion.Then, according to the equation of exchange, the velocity of money equals 8.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When more than one central bank attempts to shift the equilibrium exchange rate, we refer to this as:

A) sterilization.

B) a currency crisis.

C) coordinated intervention.

D) an application of special drawing rights.

E) a floating exchange rate system.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An excess demand for money will result in all the following, except:

A) an excess supply of bonds.

B) a rise in investment spending.

C) a fall in bond prices.

D) a fall in consumption spending.

E) a fall in equilibrium real GDP.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Increased demand for U.S.products by foreign residents will lead to a depreciation of the U.S.dollar relative to foreign currencies.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

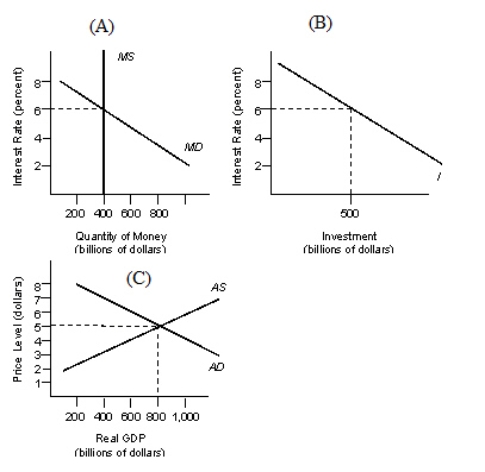

In the figure given below panel A represents money market equilibrium, panel B represents investment demand, and panel C represents equilibrium real GDP. Figure 13.3  Assume the economy is in equilibrium as illustrated by Figure 13.3.Based on the equation of exchange, what is the velocity of money?

Assume the economy is in equilibrium as illustrated by Figure 13.3.Based on the equation of exchange, what is the velocity of money?

A) 10

B) 6

C) 5

D) 20

E) 2

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To fix the foreign currency price of domestic currency below the free market equilibrium rate, a government must:

A) sell both its own currency and foreign exchange.

B) buy its own currency and sell foreign exchange.

C) buy both its own currency and foreign exchange.

D) sell its own currency and buy foreign exchange.

E) revalue its own currency.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

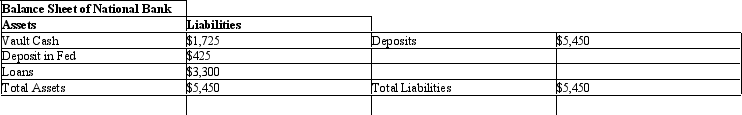

The table given below shows the assets and liabilities of the National Bank.Assume that this is the only bank in the economy. Table 13.2

Refer to Table 13.2 and calculate the legal reserves of the bank.

Refer to Table 13.2 and calculate the legal reserves of the bank.

A) $425

B) $5, 450

C) $1, 725

D) $2, 150

E) $1, 500

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

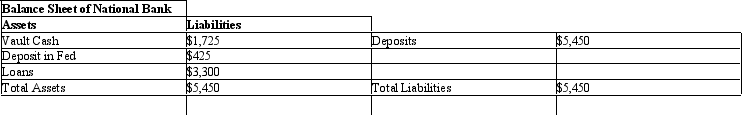

The table given below shows the assets and liabilities of the National Bank.Assume that this is the only bank in the economy. Table 13.2

Refer to Table 13.2.Calculate the change in the bank's excess reserves if the reserve requirement is decreased from 10% to 5%.

Refer to Table 13.2.Calculate the change in the bank's excess reserves if the reserve requirement is decreased from 10% to 5%.

A) +$272.5

B) +$236

C) -$2, 360

D) -$1877.5

E) -$3, 210

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The Federal Reserve (Fed)was created by the Congress as an independent agency.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After the year 2000, the FOMC changed some of its operating procedures.In particular, it stopped setting:

A) explicit interest rates for commercial banks to charge.

B) explicit ranges for money growth targets.

C) explicit number of government bonds to be bought and sold.

D) standardized real GDP targets.

E) explicit numbers for the targeted natural rates of unemployment.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to use inflation targeting, a central bank must:

A) be independent of fiscal policy.

B) be dependent on fiscal policy.

C) focus on money supply.

D) focus on unemployment.

E) focus on stable exchange rates.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The desire to keep assets in cash to take advantage of favorable changes in the value of non-cash assets is called the:

A) speculative demand for money.

B) wealth demand for money.

C) risk interest in money.

D) precautionary demand for money.

E) transactions demand for money.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 141

Related Exams